A THS Student’s Guide to Levy Discourse

A THS Student’s Guide to Levy Discourse

By L. Franks

OXFORD, OH— An oversized red and white campaign sign commands students turning into the school each morning: “Talawanda, NO More Taxes! Manage our Money!”. Meanwhile, signs propped at the ends of Oxford driveways urge residents to “VOTE!”, proclaiming “YES FOR TALAWANDA!”. This Tuesday, Oxford voters will be voting on whether or not to enact the school district’s first operating levy in 18 years.

At a meeting on May 19th, 2022, the school board passed a resolution to proceed to levy an additional tax on Oxford property owners. The decision came as an attempt to address fiscal distress and deficit spending. Having won a majority vote among the school board, the decision of whether or not to actually enact the tax increase now rests on Oxford voters. Now, as election day approaches, the Talawanda School District (TSD) has equipped its website with a page titled “2022 Levy Facts”, where voters can access resources including explanatory videos, answered FAQs, and a table that lets taxpayers estimate their annual costs based on property values.

This FAQ page began by differentiating between the types of taxes the district has levied in past years, in a pdf titled “FQA 2: Bond/Levy History”. A glossary of Ohio school finance terms, also found on the TSD website, lists twelve different types of levies. Most recently passed was a bond levy in 2008 for the construction of a new Talawanda High School. Bond levies, by definition, are specifically issued for construction purposes.

The tax on the ballot this Tuesday is an operating levy, defined simply as “a levy used primarily for district operating purposes, which can be either continuing or limited” (a limited levy is assessed for a specific period of time and must be eventually renewed or replaced, while a continuing levy is assessed indefinitely).

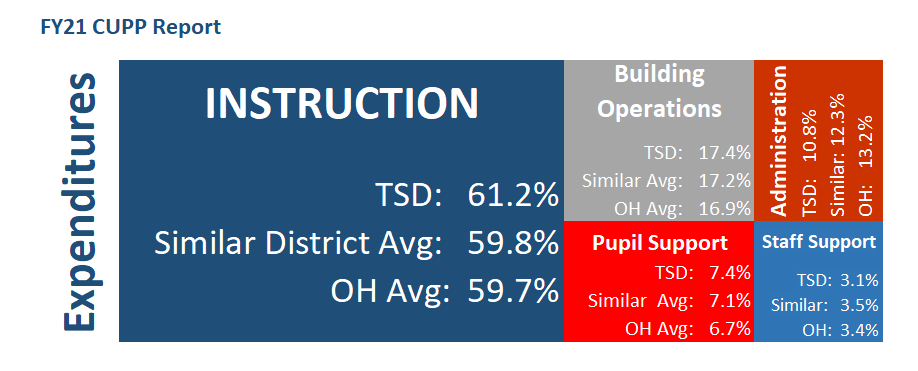

So what exactly are “operating purposes”? In a statement to the Oxford Observor in late September, Superintendent Ed Theroux said, “Talawanda provides lots of services to ensure that not only academics are provided but social and emotional support”. As noted by critics of the levy, Talawanda’s spending exceeds state averages and that of surrounding districts (see Fiscal Year 2021 CUPP Report below). But those in favor say the excess is a condition of a high quality educational experience, including programs that go beyond state requirements.

The district tackles these issue in another Q&A pdf, this one titled “FQA 3: Audit and Fiscal Distress Information”. Addressing the concerns voiced by opponents, it explains that, “While Talawanda School District is often compared to our neighboring school districts, Talawanda School District is not comparable to these districts”, citing “27-30% low socioeconomic status”, English language learners, and a far-reaching district. This is followed by a list of 30 services that TSD provides.

While its unclear at the moment exactly what steps the district will take assuming the levy fails, voters on both sides of the issue share ideas about what cuts could be made to reduce costs.

A response to “community member questions” on TSD’s website discussed reinstating Pay to Participate fees as a cost saving motion if the levy fails. In March, Ohio Auditor of State Keith Faber completed a performance audit for TSD and made the same suggestion: “The District subsidizes its extracurricular activities on a per pupil basis more than the local peers. Reinstating the pay-to-participate fee could help offset some of the District’s General Fund subsidy”.

The audit also urged TSD to make cuts to its above average staffing levels: “By reducing administrative and administrative support staff to be in line with the primary peer averages, the District could save an average of $407,400 in each year of the forecasted period”. These included central office administrators, building administrators, audio-visual staff, publicity relations staff, and building office support staff.

Similar suggestions were made regarding “ direct education and student support staff”, including general education teachers, gifted teachers, curriculum specialists, counselors, “other education positions”, psychologists, social workers, library staff positions, teaching aide positions, and monitor positions.

Citizens for Responsible and Ethical School Spending (CRESS), a local political action commitee, strongly aligns itself with the suggestions made in the audit. The homepage of its website, citizensfortalawanda.com, lists their concerns in short paragraphs under a heading titled “THE PROBLEM”. These include TSD’s per-pupil spending (“$2,000-3,000 more than our neighboring and similar school districts”), its high millage tax rate* and added income tax (compared with other schools in the area), and the levy’s timing during “a bad economy and severe inflation”.

Referencing the audit directly, the list goes on to cite “sub-par audit results”. “To date, the district has only done mediocre results in relation to the audit, and fails to prioritizing spending reduction”, the website said.

Proponents of the levy have emphasized the importance of higher spending, linking it to high quality education. CRESS believes these things aren’t mutually exclusive. “Created out of the concerns generated from the 2008 bond issue, we’ve worked diligently since then ensuring that our community’s tax dollars are well spent on our children’s education”, said a blog posted in July. “Our primary concern for this district is a high quality education for all of the students while advocating for efficient use of our financial resources and how those resources affect our community at large”. The Tribune reached out to a representative from CRESS and did not receive a response.

Supporters, on the other hand, say cutting back on programs that set TSD above neighboring districts is a risk not worth taking. Yes For Talawanda, a political action committee in support of the levy, urges voters on its website, yesfortalawanda.org: “The funds raised from the levy will directly impact the kids in our school district and we are asking you to vote FOR the TSD Levy on Tuesday, Nov 8th”.

A page on the website named “What’s At Risk” lists many of the positions and programs listed on audit: $0 pay to participate, AP/CCP/Honors, 19:1 student teacher ratios, SROs, social workers, and counselors in every building, Extra Time Extra Help, and more. Scrolling further down, under a heading titled “Testimonials”, supporters explained their personal motivations for voting Yes.

“As someone who works in Early Childhood Mental Health, I know the importance of having mental health providers, social workers, and school resource officers within the schools to maintain emotional wellbeing, family stability, and personal safety”, said Oxford resident Emily Moore. Sam Morris, a THS alumn and lifelong Oxford resident, listed four points, the final one being: “Because it’s about more than “just” education and our schools provide security, stability, mentorship, compassion, and care ESPECIALLY to those kids who don’t have all of those great things at home”.

Early in-person voting began October 11th. Now, TSD residents await election night and its uncertain consequences.

*CRESS’s estimated annual property tax does not align with the figures TSD released on its 2022 Levy Facts page. While CRESS’s website states that “for every property valued by the Butler County Auditor at $100,000 in assessed value, the property taxes will be raised an additional $570”, the Butler County Auditor’s Office estimated only $199.50 as the annual cost to taxpayer for a property of the same assessed value. A property’s taxable value is 35% of its assessed value, meaning the millage rate will only apply to $35,000 of a $100,000 property.